Paycheck calculator with 401k deduction

How much should you contribute to your 401k. Your 401k plan account might be your best tool for creating a secure retirement.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a.

. How to calculate annual income. How does a Roth IRA work. Your 401k plan account might be your best tool for creating a secure retirement.

Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. But lets say she decides to contribute 10 or 500 of her monthly salary to her 401 k account. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. How to pick 401k investments. Use our retirement calculator to see how much you might save by the time.

Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. Net pay if paid twice per month without a 401k contribution. 401k Roth 401k vs.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

Net pay if paid twice per month with a 33330 401k. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Use this calculator to help you determine the impact of changing your payroll deductions. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. For example if an employee earns 1500.

Her taxable income now shrinks to 4500 so her tax obligation also decreases from 1000 to. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. When you make a pre-tax contribution to your.

Traditional 401k Retirement calculators. If you increase your contribution to 10 you will contribute 10000. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

This California 401k calculator helps you plan for the future. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Ad Get the Payroll Tools your competitors are already using - Start Now.

Retirement Calculators and tools. Understanding the Withholding Calculator Output Internal. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

You can enter your current payroll information and deductions and then. Plus many employers provide matching contributions. Use this calculator to see how increasing your.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. You only pay taxes on contributions and earnings when the money is withdrawn.

If you increase your contribution to 10 you will contribute 10000. Ad Roll Over Funds From Your Old Retirement Account To A TIAA IRA. These are contributions that you make before any taxes are withheld from your paycheck.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. All Services Backed by Tax Guarantee.

You only pay taxes on contributions and earnings when the money is withdrawn. This calculator uses the withholding. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

It can also be used to help fill steps 3 and 4 of a W-4 form. You only pay taxes on. Choose Your Payroll Tools from the Premier Resource for Businesses.

Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA.

9 Best Free Paycheck Calculator Online Amazon Seller News Today

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Us Apps On Google Play

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

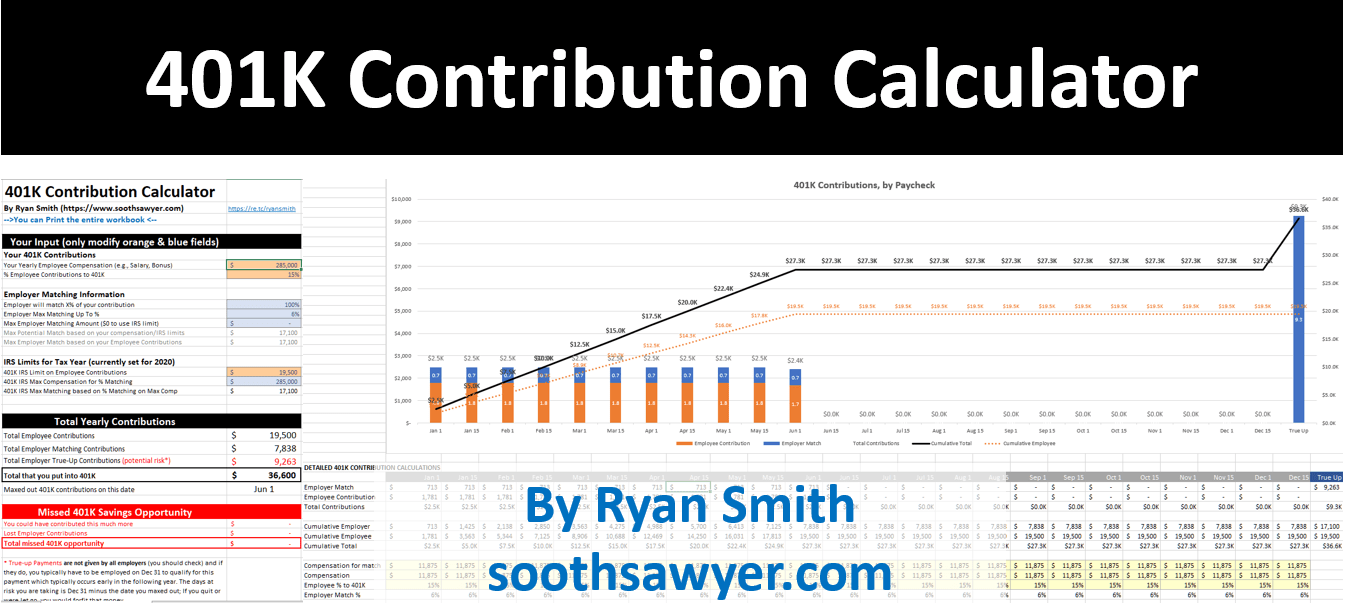

401k Employee Contribution Calculator Soothsawyer

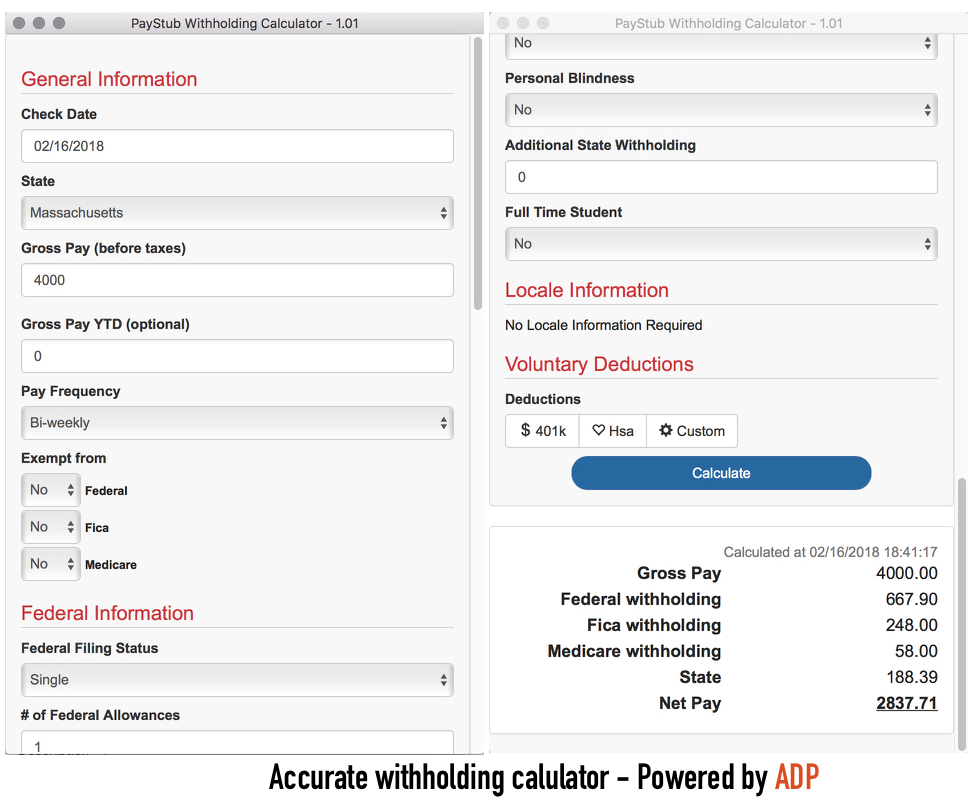

Withholding Calculator Paycheck Salary Self Employed Inchwest

Hourly Paycheck Calculator Nevada State Bank

Calculator For Paycheck Store 59 Off Www Wtashows Com

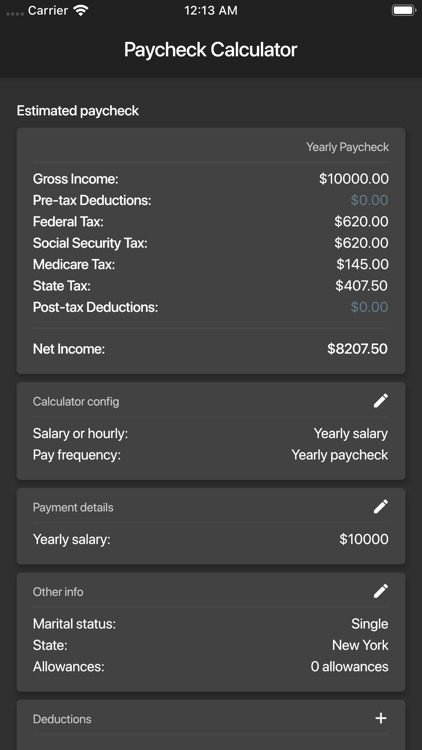

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Us Apps On Google Play

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Paycheck Calculator Us By Edwin Hernandez

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Take Home Pay Calculator

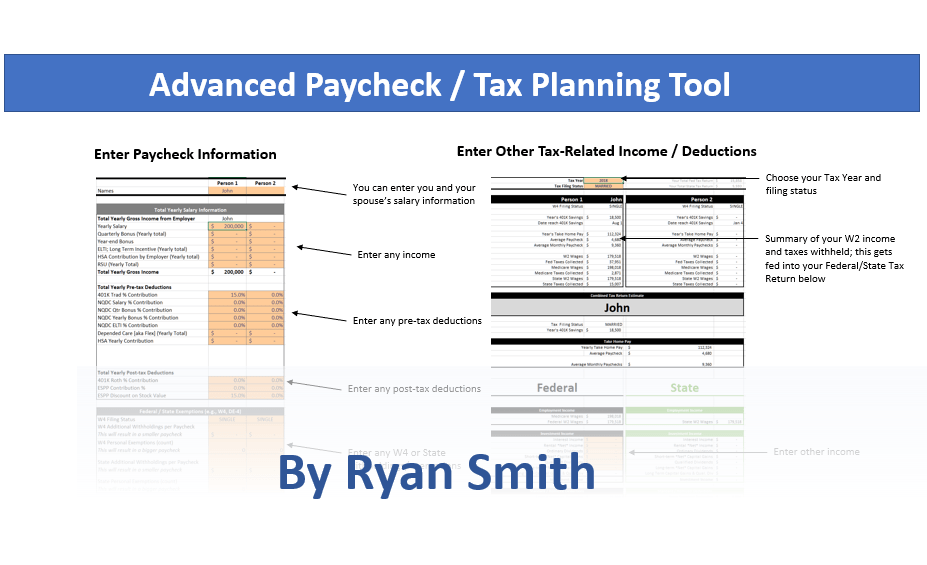

Advanced Paycheck Tax Calculator By Ryan Soothsawyer